-

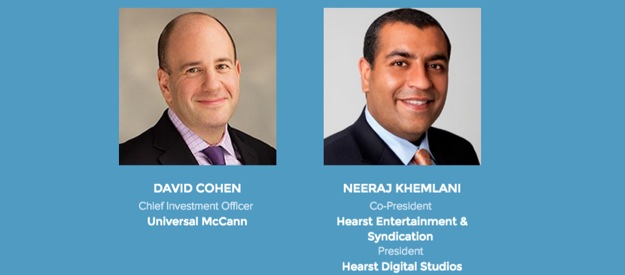

New Keynote Speaker for June 16th Video Ad Summit - David Cohen, Chief Investment Officer, Universal McCann

I'm thrilled to announce that Universal McCann Chief Investment Officer David Cohen will be the morning keynote guest at the 5th annual VideoNuze Online Video Ad Summit on Tuesday, June 16th in NYC. One of the industry's foremost innovators, David will participate in a interview with me titled "The Future of Video Advertising," in which he'll share insights on how unprecedented forces are impacting video advertising and who the ultimate winners will be in the fast-evolving landscape.

In addition, our afternoon keynote guest is Neeraj Khemlani, Co-President of Hearst Entertainment & Syndication and President, Hearst Digital Studios. Neeraj will participate in a conversation with me, titled "The Future of Video Content Providers," in which he'll explain how established media companies are transforming themselves for the online video era and new entrants are gaining audience momentum. Neeraj will also provide insight into Hearst's key video initiatives including investments in Vice, AwesomenessTV, BuzzFeed, Roku and others.

David and Neeraj are part of an all-star group of over 35 industry executives from Bonnier, CBS Interactive, Digitas, Disney/ABC, Conde Nast, Google, Heineken USA, Initiative, Nielsen, Puma, Reuters TV, Starcom, Turner Broadcasting, Viacom, Zenith Optimedia and many more who will be participating in this premier day of learning and networking!

Early bird, discounted registration expires THIS Friday, May 22nd, so don't delay. Register now to save and to win a 55-inch TCL Roku TV!

Learn more and register now!Categories: Advertising, Events

Topics: VideoNuze 2015 Online Video Advertising Summit

-

VideoNuze Podcast #273: Deciphering the Verizon-AOL Deal

I'm pleased to present the 273rd edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia.

Since Verizon announced it was acquiring AOL for $4.4 billion earlier this week, there has been a ton of media coverage, with lots of speculation about what the deal means for Verizon going forward. This is at least partly due to the companies doing a relatively poor job of articulating the deal's strategy.

In this week's podcast, Colin and I weigh in as well, focusing mainly on how AOL's video, programmatic and video syndication assets could mesh well with Verizon Digital Media Services, which already provides back-end delivery and monetization to video content providers (see here and here). Combining the two seems like the biggest point of leverage to Colin and me, yet we note that Verizon didn't even mention a VDMS role in any public comments on the deal.

Meanwhile, in a week when the pay-TV industry suffered its first-ever first quarter loss of video subscribers, we also discuss how Verizon seems intent on innovating beyond the traditional multichannel bundle.

Listen in to learn more!

Click here for previous podcasts

Click here to add the podcast feed to your RSS reader.

The VideoNuze podcast is also available in iTunes...subscribe today!Categories: Advertising, Deals & Financings, Mobile Video, Podcasts, Syndicated Video Economy, Telcos

-

Jivox Updates Platform to Streamline Dynamic Ads and Marry Them to Programmatic

Ad tech provider Jivox has announced a series of updates to its Jivox IQ platform, streamlining workflows for advertisers to create/deliver dynamic ads in programmatic environments. The end goal is for viewers to experience more personalized, relevant ads, based on data that will drive higher engagement. Jivox's founder and CEO Diaz Nesamoney recently briefed me on the updates.

Jivox has redesigned its ad creation environment as Dynamic Ad Studio based on technology it calls "Dynamic Canvas." Instead of using code templates, the technology uses dynamic ad components so assets can be resized, depending on where the ads are delivered. This also reduces the ads' weight for improved loading.Categories: Advertising, Technology

Topics: Jivox

-

Videology: Share of Multiscreen Video Ad Campaigns Tripled In Q1 '15

More evidence that video advertisers are embracing multiscreen strategies: Videology reports that in Q1 '15, 58% of all campaigns on its platform ran on more than one screen, up from just 17% in Q1 '14. Almost half (46%) of campaigns ran on Desktop/Mobile/OTT, vs. 40% on desktop only.

The most popular campaign objectives remained view-through rate and click-through rate, followed by audience verification and viewable rate. Another big shift was that 89% of campaigns ran on VPAID inventory in Q1 '15, up from 52% in Q1 '14. Videology believes this reflects brands' increased appetite for interactivity, creativity and measurability not possible in the VAST format.Categories: Advertising

Topics: Videology

-

Don't Miss Out - Register Now to Win a 55-Inch TCL Roku TV at the June 16th VideoNuze Online Video Ad Summit

Don't miss out on a chance to win a 55-inch TCL Roku TV by registering early for the 5th annual VideoNuze Online Video Ad Summit on Tuesday, June 16th in NYC.

Yesterday's Verizon-AOL deal was yet another reminder of how online video advertising and the ad tech that supports it have moved to center stage in the media industry. To learn more about why, our Video Ad Summit sessions will cover the convergence of TV and video advertising, programmatic from both the buyers' and publishers' sides, how video monetization is being modernized from both the buyers' and publishers' side, mobile video, connected TVs, the NewFronts/Upfronts, viewability and online video ad innovation.

The program features key industry thought-leaders like Kris Magel (Chief Investment Officer, Initiative), Adam Shlachter (Chief Investment Officer, Digitas), Julian Zilberbrand (EVP, Zenith Optimedia), Jackie Kulesza (EVP, Starcom), Neeraj Khemlani (Co-President, Hearst Entertainment & Syndication), Ron Amram (Sr. Media Director, Heineken), Mike Berkley (Head of Product, Viacom), plus many more.

If you need to understand what's really happening with online video advertising then the Ad Summit will be a must-attend day of learning and networking with executives from brands, agencies, content providers, technology companies and others in the ecosystem. Last year's Ad Summit drew over 420 attendees and featured 40+ speakers.

Learn more and register now!Categories: Events

Topics: VideoNuze 2015 Online Video Advertising Summit

-

The True Cost of Ad Blockers for Users and Publishers

Wednesday, May 13, 2015, 8:31 AM ETPosted by:There is a tragedy of the commons brewing in the online ecosystem. While online consumers dislike online ads enough to deploy ad blockers at an exponential rate, the vast majority of publishers rely on ads to bring content to these same users for free. If ad blocking software adoption continues to grow, what will the true cost be for each party?

We all get it - ads can detract from the user's experience. Tivo and DVRs gave television viewers a way to circumvent advertising through "ad zapping." As consumer behaviors shift to online, ad blockers have now given internet users a similar option. They simply stop requests to specified ad servers or restrict certain page elements from loading onto sites. Unless an ad meets certain criteria or the publisher pays for their site to be "whitelisted," the ad is blocked from the end-user. This includes pre-roll, mid-rolls, interstitials and any ads that are deemed non-static.Categories: Advertising

Topics: Altitude Digital

-

Verizon-AOL Deal is a Bet on Video, Mobile and Programmatic, With Content the Odd Man Out

Verizon's surprise $4.4 billion acquisition of AOL, looks like mostly a bet on video, mobile, and programmatic, with content likely the odd man out.

The deal gives Verizon a bigger play in 3 of the biggest trends in the media business - the explosion of personalized, on-demand video viewership, the massive adoption of mobile lifestyles via smartphones, and the shift to automated, data-driven ad buying through programmatic platforms. AOL has been pursuing all of these over the past few years through internal growth and acquisitions.Categories: Deals & Financings, Telcos

-

Cord-Cutting Accelerates in Q1 '15 as Pay-TV Operators Lose 31K Subscribers

U.S. pay-TV operators lost 31K video subscribers in Q1 '15, compared to a gain of 271K in Q1 '14, according to analysts MoffettNathanson. The loss was the first time the industry has ever lost subscribers in a first quarter, and signals an acceleration of cord-cutting (or cord-nevering, since it's hard to pull the two apart), contributing to a .5% industry contraction over the past 4 quarters (461K subscribers).

MoffettNathanson has always tried to put pay-TV results in context with both occupied housing net additions and new household net additions. In Q1, the former declined by 407K, but the latter increased by 1.3 million, suggesting around 900K households were added in the U.S. Despite the gain the industry still lost subscribers.Categories: Cable TV Operators, Satellite, Telcos

Topics: AT&T, Comcast, DirecTV, Dish Network, MoffettNathanson LLC, Time Warner Cable, Verizon